A clearing house is an arrangement which offers clearing and settlement services for cheques and other payment instruments. The Bank of Mauritius Act empowers the Bank of Mauritius to organise in conjunction with authorised banks, a clearing house to facilitate the clearing of cheques and other credit instruments. The Port Louis Automated Clearing House (PLACH) which comprises all domestic banks and the Mauritius Civil Service Mutual Aid Association, is the only clearing house in Mauritius. The operations of the clearing house are governed by the PLACH Rules which are issued under the Bank of Mauritius Act.

The Bulk Clearing System

The operations of the clearing house are automated through an electronic platform called the Bulk Clearing System. This system provides its Participants of the PLACH with a facility for presenting interbank retail payments in batches, to one another, at specific times. The payment instructions may include cheques, debit instructions or direct credit instructions.

The payment instructions in each batch are netted, that is, it is determined whether a participant has a net value to pay or to receive. Participants’ net positions are settled on MACSS.

Cheque Truncation System

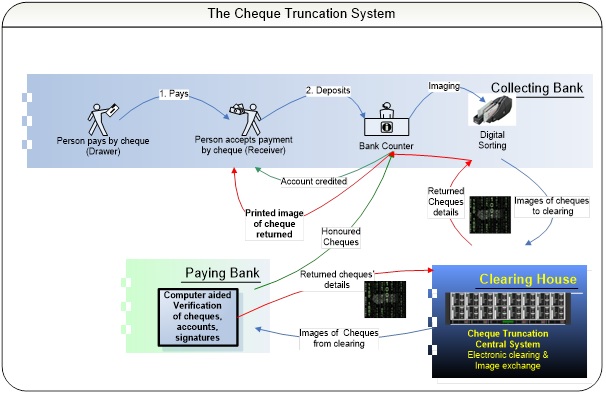

The Cheque Truncation System (CTS) is a feature of the BCS which enables electronic clearing of cheques through the cheque MICR data and scanned cheque images. The physical cheques remain with banks where they are deposited and their scanned images are sent to paying banks. This process eliminates the physical movement of cheques from collecting banks to paying banks thereby reducing processing time and float time required to make funds available to the beneficiary. The CTS is an effective tool for monitoring of the process to make cheque clearing faster and more secure. The system is capable of detecting duplicate, fake or tampered-with cheques.

Cheque truncation allows funds to be made available to beneficiaries on a T+2 basis, i.e, two days after the cheque is presented at the clearing house.

The process flow of the CTS is depicted in the diagram which follows:

Electronic Fund Transfers

Electronic Fund Transfer s (EFT) is also a feature of the BCS. EFTs are fund transfers from customers of the sending bank to customers of a receiving bank. These may include repayment of credit card bills, sundry credits, standing credit operations, salary credits, dividend credits, inward remittance credits, pension credits, international payment orders, subscriptions etc. EFTs are presented through batch files which are cleared four times a day through the bulk clearing system.

Direct Debit

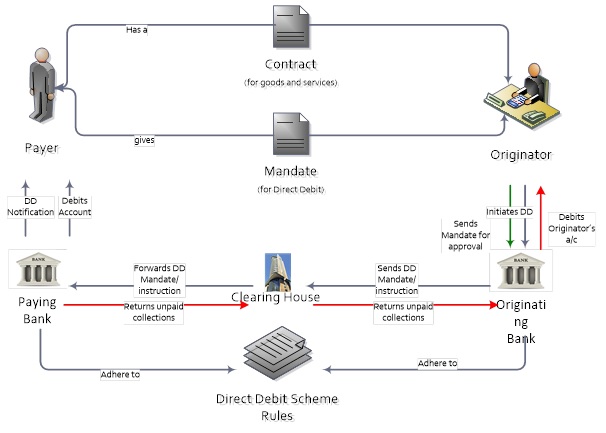

The Direct Debit is a four-party arrangement for collection of money between two through their respective banks. The Direct Debit model is schematically described below:

Direct Debits are initiated by the Originator, who receives the payment, through his bank in the PLACH. The Payer’s bank debits his account and remits the funds to the Originator’s bank for payment to the Originator.

Direct Debit transactions are based on an authorization or ‘Mandate’ given by the Payer to the Originator for debit of the Payer’s account. The Payer as well as the Originator must hold an account with a bank which is a participant in the PLACH.

Accreditation of cheque printers and MICR Encoders

Payment by cheque remains one of the preferred modes of payment in Mauritius in spite of the introduction of a spectrum of alternative payment modes. Payment by cheque may become a source of systemic problem to the national payment system if associated risks are not controlled. Risks associated with cheques span from the printing stage up to the clearing and settlement.

Printing and MICR encoding of cheques under strict control are critical to avoid fraudulent transactions that can affect the credibility of the national payment system. Therefore, only entities accredited by the Bank are allowed to carry on the business of cheque printing and MCIR encoding.