Page 41 - June 2017

P. 41

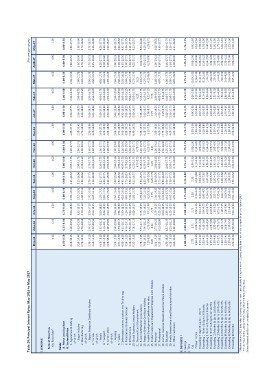

Table 28: Principal Interest Rates: May 2016 to May 2017 p p p (Per cent pper annum)

Feb-17 Mar-17

May-16 June-16 July-16 Aug-16 Sep-16 Oct-16 Nov-16 Dec-16 Jan-17 April-17 May-17

I. LENDING

Bank of Mauritius 4.40 4.40 4.00 4.00 4.00 4.00 4.00 4.00 4.00 4.00 4.00 4.00 4.00

Key Repo Rate 1

Banks 6.25-8.50 6.25-8.50 6.25-8.50 6.00-8.50 6.00-8.50 6.00-8.50 6.00-8.50 6.00-8.50 6.00-8.50 6.00-8.50 6.00-8.50 6.00-8.50 6.00-8.50

A. Prime Lending Rate

B. Sectoral Rates 3.00-18.15 3.00-18.50 3.00-18.50 2.90-18.50 2.85-18.50 2.85-17.75 2.90-17.75 2.85-17.75 2.90-17.75 2.90-18.50 2.90-18.50 2.80-18.50 2.80-17.75

1. Agriculture & Fishing

of which 3.15-10.40 3.15-13.85 3.12-13.15 3.12-15.75 3.12-16.90 2.90-15.75 2.90-12.75 2.90-13.45 2.90-10.75 2.90-16.75 2.90-12.75 2.80-16.90 2.80-10.00

- Sugar Industry 2.70-18.50 2.70-18.50 2.70-18.50 2.30-18.50 2.30-18.50 2.30-18.50 3.00-18.50 2.70-18.50 3.00-18.50 3.00-18.50 3.00-18.50 2.70-18.50 2.70-18.50

2. Manufacturing

of which 2.70-18.15 2.70-17.15 2.70-17.15 2.70-16.90 2.70-17.75 2.75-17.75 3.65-17.75 2.70-16.90 5.00-16.75 3.50-16.75 3.50-16.75 2.70-16.75 2.70-16.75

- Export Enterprise Certificate Holders 4.50-18.15 4.50-18.50 4.50-18.15 4.50-18.15 4.50-18.00 4.00-18.00 4.00-18.00 4.00-18.00 5.00-18.00 4.50-18.00 4.50-18.00 4.25-18.00 4.25-18.00

3. Tourism

of which 6.00-18.15 5.65-18.15 5.00-18.15 5.25-17.75 5.25-17.75 5.10-17.75 5.00-17.75 5.00-17.75 5.00-17.75 4.50-17.75 4.50-17.75 4.25-17.75 4.25-17.75

- Hotels 3.95-18.15 3.95-18.15 4.00-18.15 3.80-17.75 4.00-17.75 4.00-18.50 4.00-17.75 4.00-18.50 4.00-18.00 4.00-18.00 4.00-18.00 4.00-18.00 4.00-18.00

4. Transport 2.00-18.50 2.00-19.00 2.00-19.00 2.00-19.00 2.00-19.00 2.00-18.50 2.00-19.00 2.00-18.50 2.00-18.50 2.00-18.50 2.00-18.25 2.00-18.50 2.00-18.25

5. Construction

of which 2.00-18.50 2.00-19.00 2.00-19.00 2.00-19.00 2.00-19.00 2.00-18.50 2.00-19.00 2.00-18.50 2.00-18.50 2.00-18.50 2.00-18.25 2.00-18.25 2.00-18.25

- Housing 1.97-18.50 1.94-18.15 1.94-18.50 1.93-18.50 1.92-18.50 1.93-18.50 1.92-18.50 1.91-18.50 1.91-18.50 2.00-18.50 2.00-18.50 2.00-18.50 2.00-18.50

6. Traders 4.35-18.15 4.35-18.15 5.80-18.15 4.15-18.50 4.35-18.50 4.35-17.75 3.00-18.50 3.00-18.50 4.35-18.50 3.00-18.50 3.00-18.50 4.35-18.50 4.35-17.75

7. Information communication and Technology 4.10-19.15 4.05-19.15 4.10-19.15 4.05-19.15 3.75-19.15 3.75-19.15 3.85-18.50 3.85-19.15 3.85-19.15 3.85-19.15 3.00-17.75 3.00-17.75 3.00-17.75

8. Financial and Business Services 5.50-18.15 5.50-18.15 5.50-18.15 5.50-17.75 5.50-17.75 5.50-17.75 5.50-17.75 5.50-17.75 5.00-17.75 5.50-17.75 6.00-17.75 4.10-17.75 4.10-17.75

9. Infrastructure 6.32-16.15 5.00-17.15 5.00-16.15 5.00-15.75 6.25-16.75 6.25-15.75 6.25-15.75 8.95-16.75 5.00-16.75 5.00-16.75 6.25-15.75 6.25-15.75 6.25-15.75

10. Global Business Licence Holders

11. State and Local Government - - - - - 6.75-8.75 6.75-7.75 - - 6.25 6.25 - -

12. Public Nonfinancial Corporations 5.75-17.15 5.75-17.15 5.75-16.15 5.35-18.50 5.35-15.75 5.35-15.75 5.35-15.75 5.35-15.75 5.35-15.75 5.35-15.75 6.00-15.75 6.00-9.90 5.35-10.00

13. Freeport Enterprise Certificate Holders 7.90-18.15 7.90-18.15 7.75-18.15 7.50-18.50 6.25-17.75 6.25-17.75 6.25-17.75 6.25-17.75 5.00-15.75 6.25-15.75 6.25-15.75 6.25-15.75 6.25-15.75

14. Health Development Certificate Holders 6.25-8.00

15. Modernisation and Expansion Entreprise Cert. Holders 7.20-8.50 6.75-9.50 6.75-7.00 6.55-9.50 4.00-9.50 4.00-9.50 6.25-8.75 6.55-7.00 5.00-8.75 6.25-7.25 6.25-8.00 6.25-8.75

16. Personal 8.20 8.20 7.75 7.75 6.25-7.75 6.25 6.25 - 7.75 7.75 - - -

17. Professional 2.50-19.25 1.00-19.25 1.00-19.25 1.00-19.25

18. Human Resource Development Certificate Holders 3.00-19.25 2.75-19.25 2.75-19.25 2.50-19.25 5.75-17.75 2.50-19.25 1.00-19.25 2.85-19.25 4.00-17.75 4.00-17.75 3.00-19.25 4.30-17.75 3.00-19.25

19. Education 6.25-18.15 6.25-18.90 6.25-18.15 5.45-18.15 9.50-18.00 4.00-17.75 4.00-17.75 4.00-17.75 6.25-8.75 6.25-8.75 4.00-17.75 4.30-17.75

20. Media, Entertainment and Recreational Activities 9.50-18.15 9.50-18.00 4.00-17.75 9.50-18.00 17.75-18.00 5.00-17.75 6.00-17.75 -

21. Other Customers - - 4.35-18.15 4.15-17.75 5.50-17.75 - 6.25-17.75 6.00-17.75 5.50-17.75 5.50-17.75 - 6.00-17.75 -

4.35-18.15 4.35-18.15 6.25-18.15 6.00-18.15 4.00-18.00 4.00-17.75 5.50-17.75 4.00-17.75 2.00-18.00 4.00-18.00 6.00-17.75 5.50-17.75 6.00-17.75

6.25-18.15 6.25-18.15 3.50-18.15 4.35-18.00 5.50-17.75 3.70-18.50 2.00-18.50 5.50-17.75 4.00-18.00 5.50-17.75

4.85-18.00 4.80-18.00 3.70-18.00 4.00-18.00 4.15-18.00

II. DEPOSITS * 2.00-4.00 2.00-4.00 2.00-4.00 1.75-4.00 1.75-4.00 1.75-2.75 1.75-2.75 1.75-2.75 1.75-2.75 1.75-2.75 1.75-2.75 1.75-2.75 1.75-2.75

1. Savings

2. Time 2.75 2.75 2.75 2.30 2.30 0.50-2.30 0.50-2.30 0.50-2.30 0.00-2.80 0.00-2.80 0.00-2.80 0.00-2.30 0.00-2.80

0.30-5.25 0.30-5.25 0.30-5.25 0.10-4.80 0.10-4.80 0.10-4.80 0.10-4.80 1.00-4.80 0.10-0.40 0.10-2.30 0.10-0.40 0.10-0.40 0.10-2.30

Call 0.15-4.10 0.15-4.10 0.15-2.50 0.10-2.30 0.10-2.55 0.10-2.50 1.00-2.50 0.10-3.60 0.10-2.50 0.50-2.50 0.40-1.95 0.40-2.10 0.30-2.10

7 Days' Notice 0.30-4.25 0.30-3.60 0.30-4.75 0.45-4.75 0.05-3.65 0.45-3.55 0.10-3.65 0.10-3.60 0.10-3.55 0.10-3.55 0.10-2.90 0.10-3.25 0.50-3.00

Exceeding 7 Days & Up to 1 Month 0.50-4.10 0.50-4.10 0.10-5.75 0.10-5.75 0.30-4.00 0.30-4.20 0.30-4.20 0.30-6.20 0.50-4.20 0.50-3.00 1.40-2.80 0.90-3.50 0.40-2.90

Exceeding 1 Month & Up to 3 Months 0.05-5.00 0.05-5.00 0.05-5.50 0.05-5.75 0.05-5.55 0.05-5.55 0.05-5.55 0.05-5.55 0.05-4.00 0.75-4.00 1.00-4.00 1.40-4.20 1.00-4.25

Exceeding 3 Months & Up to 6 Months 1.35-4.85 1.35-4.85 1.85-6.20 2.55-5.70 1.00-4.50 1.95-5.06 1.95-4.50 1.95-4.50 2.55-2.80 2.55-3.50 1.55-2.70 1.90-3.75 1.00-3.50

Exceeding 6 Months & Up to 12 Months 0.75-5.75 0.75-5.75 0.75-5.75 0.75-6.20 0.75-5.25 0.75-5.25 0.75-5.25 0.75-5.25 2.30-4.25 2.05-4.30 1.40-4.25 1.75-4.80 1.75-4.10

Exceeding 12 Months & Up to 18 Months 1.00-7.25 1.00-7.25 1.00-7.25 1.00-7.20 1.00-6.80 1.00-6.80 1.00-6.80 1.00-6.80 2.30-4.50 1.50-4.50 1.90-4.50 2.30-4.50 1.80-4.15

Exceeding 18 Months & Up to 24 Months 2.00-7.45 2.00-7.45 2.00-7.45 2.00-7.09 2.00-7.09 2.00-7.09 2.00-7.09 2.00-7.09 2.55-4.65 2.30-3.60 2.40-4.25 2.30-4.25 2.10-4.40

Exceeding 24 Months & Up to 36 Months 2.35-8.50 2.35-8.50 2.35-8.50 2.35-8.05 2.30-8.05 2.30-8.05 2.30-8.05 2.30-8.05 3.23-5.00 2.80-6.25 2.60-5.00 2.70-5.00 2.15-4.90

Exceeding 36 Months & Up to 48 Months 2.90-10.30 2.90-10.30 2.90-10.30 2.90-10.30 2.50-10.30 2.44-10.30 2.50-10.30 2.50-10.30 2.80-3.45 2.95-4.30 2.95-4.50 2.80-4.20 3.00-4.00

Exceeding 48 Months & Up to 60 Months

Exceeding 60 Months

* Effective January 2017, data refers to interest rates on new rupee deposits during the month. Consequently, data is not strictly comparable prior to January 2017.

1 The key Repo Rate is used as the key policy rate of the Bank of Mauritius.

Source: Research and Economic Analysis Department.