Page 26 - May 2017

P. 26

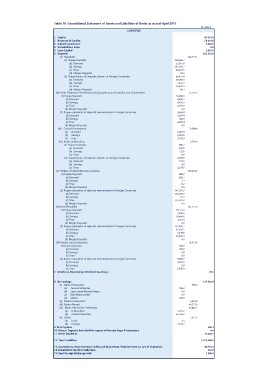

Table 18: Consolidated Statement of Assets and Liabilities of Banks as at end-April 2017 (Rs million)

LIABILITIES

1. Capital 320,640.7 389,114.1 66,361.9

2. Reserves & Surplus 53,055.6 25,725.5 59,418.6

3. Subordinated Loan 8,690.4

4. Shareholders Loan 207,105.1 2,749.4 6,802.2

5. Loan Capital 60,430.5 0.0

6. Deposits 49.4 348,279.2

68,473.4 147,273.4 8,863.9

(I) Residents 49,010.8 932,183.8

(1) Rupee Deposits 2,974.1 10,351.6

(a) Demand 16,428.3 20.5

(b) Savings 60.3

(c) Time

(d) Margin Deposits 16,080.8

(2) Rupee Equiv. of Deposits denom. in Foreign Currencies 4,660.7

(a) Demand 4,820.3

(b) Savings 6,599.7

(c) Time 0.0

(d) Margin Deposits 9,644.8

5,247.4

(II) Public Financial & Nonfinancial Corporations and State & Local Government 168.0

(1) Rupee Deposits 4,229.4

(a) Demand 0.0

(b) Savings

(c) Time 2,035.9

(d) Margin Deposits 2,935.6

(2) Rupee equivalent of deposits denominated in Foreign Currencies 3,718.9

(a) Demand

(b) Savings 356.1

(c) Time 323.5

(d) Margin Deposits

32.6

(III). Central Government 0.0

(a) Demand

(b) Savings 2,393.3

(c) Time 173.8

0.0

(IV) Banks in Mauritius

(1) Rupee Deposits 2,219.5

(a) Demand

(b) Savings 886.0

(c) Time 808.7

(2) Rupee Equiv. of Deposits denom. in Foreign Currencies

(a) Demand 7.1

(b) Savings 70.2

(c) Time

0.0

(V) Holders of Global Business Licences 347,393.2

(1) Rupee Deposits 224,029.2

(a) Demand

(b) Savings 61.2

(c) Time 123,302.9

(d) Margin Deposits

(2) Rupee equivalent of deposits denominated in Foreign Currencies 0.0

(a) Demand

(b) Savings 16,271.4

(c) Time 1,868.9

(d) Margin Deposits

10,640.6

(VI) Non-Residents 3,761.8

(1) Rupee Deposits 0.0

(a) Demand

(b) Savings 131,002.1

(c) Time 92,630.2

(d) Margin Deposits 1,439.6

(2) Rupee equivalent of deposits denominated in Foreign Currencies 36,932.3

(a) Demand 0.0

(b) Savings

(c) Time 702.0

(d) Margin Deposits 702.0

(VII) Banks outside Mauritius 0.0

(1) Rupee Deposits 0.0

(a) Demand 9,649.7

(b) Savings 4,013.7

(c) Time* 0.0

(2) Rupee equivalent of deposits denominated in Foreign Currencies 5,635.9

(a) Demand

(b) Savings

(c) Time

7. Interbank Borrowings (National Currency )

8. Borrowings 156.3 756.2 127,502.6

(i) Bank of Mauritius 0.0

(a) Secured Advances 0.0 5,453.0 548.1

(b) Loan raised through Repos 49,313.8 0.0

(c) Bills Rediscounted 599.9 69,042.1

(d) Others 71,698.7

(ii) Banks in Mauritius 1 5,335.2 2,937.5

(iii) Banks Abroad 63,706.9

(iv) Banks Abroad for Onlending

(a) in Mauritius 3.3

(b) outside Mauritius 2,934.2

(v) Other

(a) Local 1,273,400.2

(b) Foreign

60,761.4

9. Bills Payable 653.0

10. Margin Deposits from BoM in respect of Reverse Repo Transactions

11. Other Liabilities 7,380.5

12. Total Liabilities

13. Acceptances, Documentary Credits and Guarantees, Endorsements on A/c of Customers

14. Inward Bills Held for Collection

15. Spot Foreign Exchange sold