Page 52 - May 2017

P. 52

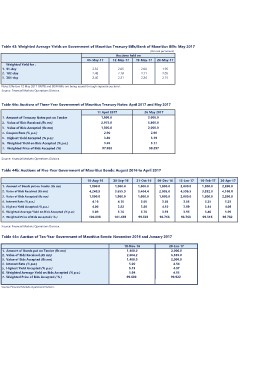

Table 43: Weighted Average Yields on Government of Mauritius Treasury Bills/Bank of Mauritius Bills: May 2017

(Per cent per annum)

Auctions held on

05-May-17 12-May-17 19-May-17 26-May-17

Weighted Yield for :

1. 91-day 2.32 2.05 2.00 1.95

2. 182-day 2.48 2.18 2.11 2.05

3. 364-day 2.45 2.31 2.24 2.15

Note: Effective 12 May 2017 GMTB and BOM Bills are being issued through separate auctions.

Source: Financial Markets Operations Division.

Table 44a: Auctions of Three-Year Government of Mauritius Treasury Notes: April 2017 and May 2017

1. Amount of Treasury Notes put on Tender 11 April 2017 26 May 2017

2. Value of Bids Received (Rs mn) 1,800.0 2,000.0

3. Value of Bids Accepted (Rs mn) 2,975.0 5,800.0

4. Coupon Rate (% p.a.) 1,800.0 2,000.0

5. Highest Yield Accepted (% p.a.) 2.90 2.90

6. Weighted Yield on Bids Accepted (% p.a.) 3.80 3.19

7. Weighted Price of Bids Accepted (%) 3.65 3.17

97.982 99.297

Source: Financial Markets Operations Division.

Table 44b: Auctions of Five-Year Government of Mauritius Bonds: August 2016 to April 2017

1. Amount of Bonds put on Tender (Rs mn) 19-Aug-16 20-Sep-16 21-Oct-16 09-Dec-16 13-Jan-17 10-Feb-17 20-Apr-17

2. Value of Bids Received (Rs mn) 1,800.0 1,800.0 1,600.0 1,600.0 2,000.0 1,800.0 2,200.0

3. Value of Bids Accepted (Rs mn) 4,240.9 3,655.9 3,404.4 2,005.0 4,596.5 3,832.0 4,100.0

4. Interest Rate (% p.a.) 1,800.0 1,800.0 1,600.0 1,600.0 2,000.0 1,800.0 2,200.0

5. Highest Yield Accepted (% p.a.) 4.10 4.10 3.65 3.25

6. Weighted Average Yield on Bids Accepted (% p.a.) 4.00 3.82 3.65 4.10 3.65 3.25 4.09

7. Weighted Price of Bids Accepted ( % ) 3.89 3.76 3.88 3.93 3.99 3.44 3.99

100.898 101.439 3.76 98.768 3.93 3.40 96.782

Source: Financial Markets Operations Division. 99.503 98.768 99.316

Table 44c: Auction of Ten-Year Government of Mauritius Bonds: November 2016 and January 2017

1. Amount of Bonds put on Tender (Rs mn) 18-Nov-16 20-Jan-17

2. Value of Bids Received (Rs mn) 1,400.0 2,000.0

3. Value of Bids Accepted (Rs mn) 2,604.2 6,593.0

4. Interest Rate (% p.a.) 1,400.0 2,000.0

5. Highest Yield Accepted (% p.a.) 5.00 4.94

6. Weighted Average Yield on Bids Accepted (% p.a.) 5.15 4.97

7. Weighted Price of Bids Accepted ( % ) 5.04 4.95

99.689 99.922

Source: Financial Markets Operations Division.