Page 51 - May 2017

P. 51

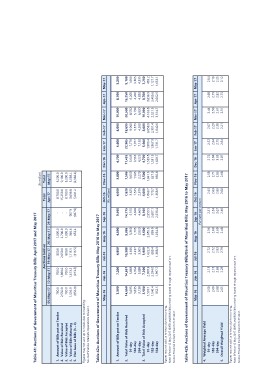

Table 41: Auctions of Government of Mauritius Treasury Bills: April 2017 and May 2017 Total (Rs million)

Apr-17 Total

Auctions held on

05-May-17 12-May-17 19-May-17 26-May-17 29-May-17 May-17

1. Amount of Bills put on Tender 700.0 700.0 800.0 1,000.0 - 8,700.0 3,200.0

2. Value of Bids Received 2,550.0 1,800.0 2,050.0 2,700.0 - 15,250.0 9,100.0

3. Value of Bids Accepted 1,000.0 - 3,200.0

4. Value of Bills Maturing 700.0 700.0 800.0 907.9 8,700.0 5,538.4

5. Net Issue of Bills (3 - 4) 1,556.9 1,613.5 1,113.5 346.6 (907.9) 3,698.8 (2,338.4)

(856.9) (913.5) (313.5) 653.4 5,001.2

Figures may not add up to totals due to rounding.

Source:Financial Markets Operations Division.

Table 42a: Auctions of Government of Mauritius Treasury Bills: May 2016 to May 2017

May-16 Jun-16 Jul-16 Aug-16 Sep-16 Oct-16 Nov-16 Dec-16 Jan-17 Feb-17 Mar-17 Apr-17 May-17

(Rs million)

1. Amount of Bills put on Tender 3,900 7,200 4,800 4,600 9,500 4,000 3,800 4,700 5,600 8,000 10,000 8,700 3,200

2. Total Value of Bids Received 14,660 14,691 10,388 9,085 14,775 7,820 7,505 11,435 22,905 18,695 20,500 15,250 9,100

91-day 5,695 5,868 4,646 5,360 5,510 3,625 3,650 3,645 7,778 9,060 8,550 6,200 1,600

182-day 5,835 4,934 2,437 1,705 4,600 1,525 1,585 3,565 7,977 5,375 5,130 4,200 3,165

364-day 3,130 3,889 3,305 2,020 4,665 2,670 2,270 4,225 7,150 4,260 6,820 4,850 4,335

3,900 7,200 3,900 4,600 8,100 4,000 3,500 4,700 5,600 8,000 8,700 3,200

3. Total Value of Bids Accepted 2,685.3 1,860.7 1,841.3 10,000 439.2

91-day 1,507.1 2,908.3 1,622.3 859.9 2,959.5 770.7 827.9 1,539.8 1,900.4 3,858.0 4,163.8 3,636.9 1,127.7

182-day 1,540.4 2,294.0 889.4 1,054.8 2,607.1 1,368.6 830.8 1,531.5 1,967.9 2,301.4 2,521.5 2,400.6 1,633.1

364-day 1,997.7 2,533.4 1,628.7 1,731.7 1,840.6 3,314.7 2,662.5

852.5 1,388.3

Figures may not add up to totals due to rounding.

Note: Effective 12 May 2017 GMTB and BOM Bills are being issued through separate auctions.

Source: Financial Markets Operations Division.

Table 42b: Auctions of Government of Mauritius Treasury Bills/Bank of Mauritius Bills: May 2016 to May 2017

May-16 Jun-16 Jul-16 Aug-16 Sep-16 Oct-16 Nov-16 Dec-16 Jan-17 Feb-17 Mar-17 Apr-17 May-17

Per cent per annum

4. Weighted Average Yield 2.50 2.13 2.72 2.36 2.21 2.43 2.58 2.72 2.52 2.07 2.44 2.68 2.04

91-day 2.66 2.15 2.72 2.60 2.54 2.63 2.71 2.84 2.64 2.29 2.50 2.75 2.13

182-day 2.88 2.68 2.93 2.69 2.67 2.80 2.85 3.05 2.75 2.38 2.61 2.82 2.25

364-day 2.65 2.29 2.79 2.48 2.46 2.60 2.68 2.87 2.64 2.21 2.51 2.75 2.12

5. Overall Weighted Yield

Figures may not add up to totals due to rounding.

Note: Effective 12 May 2017 GMTB and BOM Bills are being issued through separate auctions.

Source: Financial Markets Operations Division.