Page 54 - May 2017

P. 54

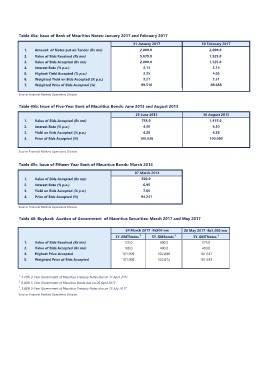

Table 45a: Issue of Bank of Mauritius Notes: January 2017 and February 2017

1. Amount of Notes put on Tender (Rs mn) 31 January 2017 10 February 2017

2. Value of Bids Received (Rs mn) 2,000.0 2,000.0

3. Value of Bids Accepted (Rs mn) 5,675.0 1,525.0

4. Interest Rate (% p.a.) 2,000.0 1,525.0

5. Highest Yield Accepted (% p.a.) 3.14 3.14

6. Weighted Yield on Bids Accepted (% p.a.) 3.35 4.05

7. Weighted Price of Bids Accepted (%) 3.27 3.51

99.516 98.638

Source: Financial Markets Operations Division. 30 August 2013

1,435.0

Table 45b: Issue of Five-Year Bank of Mauritius Bonds: June 2013 and August 2013 4.30

4.28

1. Value of Bids Accepted (Rs mn) 21 June 2013 100.080

2. Interest Rate (% p.a.) 758.0

3. Yield on Bids Accepted (% p.a.) 4.30

4. Price of Bids Accepted (%) 4.29

100.036

Source: Financial Markets Operations Division.

Table 45c: Issue of Fifteen-Year Bank of Mauritius Bonds: March 2014

1. Value of Bids Accepted (Rs mn) 07 March 2014

2. Interest Rate (% p.a.) 500.0

3. Yield on Bids Accepted (% p.a.) 6.95

4. Price of Bids Accepted (%) 7.60

94.241

Source: Financial Markets Operations Division.

Table 46: Buyback Auction of Government of Mauritius Securities: March 2017 and May 2017

24 March 2017 -Rs500 mn 26 May 2017 -Rs1,000 mn

3Y-GMTNotes 3

3Y-GMTNotes 1 5Y-GMBonds 2 575.0

400.0

1. Value of Bids Received (Rs mn) 125.0 500.0 101.637

2. Value of Bids Accepted (Rs mn) 101.633

4. Highest Price Accepted 100.0 400.0

5. Weighted Price of Bids Accepted

101.999 102.880

101.998 102.874

1 4.10% 3-Year Government of Mauritius Treasury Notes due on 11 April 2017

2 6.00% 5-Year Government of Mauritius Bonds due on 20 April 2017

3 3.88% 3-Year Government of Mauritius Treasury Notes due on 25 July 2017

Source: Financial Markets Operations Division.