Page 69 - June 2017

P. 69

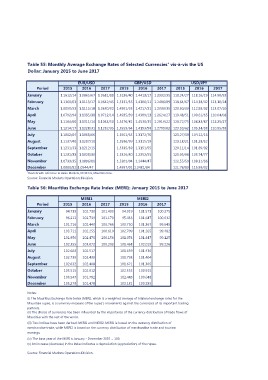

Table 55: Monthly Average Exchange Rates of Selected Currencies1 vis-à-vis the US

Dollar: January 2015 to June 2017

Period EUR/USD GBP/USD USD/JPY

2015 2016 2017 2015 2016 2017 2015 2016 2017

January 1.1612/14 1.0865/67 1.0631/33 1.5136/40 1.4413/17 1.2332/35 118.24/27 118.16/19 114.90/93

February 1.1360/63 1.1113/17 1.0642/45 1.5331/35 1.4306/11 1.2486/89 118.64/67 114.38/42 113.10/14

March 1.0850/53 1.1115/18 1.0680/82 1.4991/95 1.4217/21 1.2333/35 120.30/33 112.98/02 113.07/10

April 1.0792/94 1.1335/38 1.0712/14 1.4935/39 1.4309/13 1.2624/27 119.48/51 109.61/65 110.04/08

May 1.1164/66 1.1311/14 1.1048/50 1.5476/81 1.4530/35 1.2919/22 120.72/75 108.83/87 112.25/27

June 1.1214/17 1.1228/31 1.1232/35 1.5559/64 1.4193/98 1.2799/02 123.59/62 105.34/38 110.85/88

July 1.1002/04 1.1063/66 1.5561/65 1.3172/76 123.27/30 104.12/16

August 1.1137/40 1.1207/10 1.5596/99 1.3115/19 123.18/21 101.28/32

September 1.1231/33 1.1212/15 1.5335/39 1.3151/55 120.11/14 101.89/92

October 1.1231/33 1.1028/30 1.5326/30 1.2352/55 120.05/08 103.74/77

November 1.0733/35 1.0806/08 1.5201/04 1.2444/47 122.55/59 108.31/36

December 1.0880/82 1.0544/47 1.4997/01 1.2481/84 121.76/80 115.99/02

1Reuters with reference to Asian Markets, 09 30 hrs, Mauritian time.

Source: Financial Markets Operations Division.

Table 56: Mauritius Exchange Rate Index (MERI): January 2015 to June 2017

Period 2015 MERI1 2017 2015 MERI2 2017

January 2016 101.439 2016 100.275

February 101.170 100.032

March 94.738 102.738 100.766 94.019 101.573 99.645

April 100.610 99.482

May 96.211 102.739 100.156 95.433 101.647 99.125

June 100.203 99.226

July 101.716 102.440 100.750 101.367

August

September 103.711 102.255 102.709 101.265

October

November 101.956 102.470 101.074 101.447

December

102.355 103.072 101.468 102.019

102.608 102.517 101.659 101.430

102.739 102.438 101.798 101.404

102.632 102.408 101.671 101.365

103.515 102.012 102.555 100.915

103.547 101.792 102.445 100.648

103.279 101.478 102.181 100.285

Notes:

(i) The Mauritius Exchange Rate Index (MERI), which is a weighted average of bilateral exchange rates for the

Mauritian rupee, is a summary measure of the rupee's movements against the currencies of its important trading

partners.

(ii) The choice of currencies has been influenced by the importance of the currency distribution of trade flows of

Mauritius with the rest of the world.

(iii) Two indices have been derived: MERI1 and MERI2. MERI1 is based on the currency distribution of

merchandise trade, while MERI2 is based on the currency distribution of merchandise trade and tourism

earnings.

(iv) The base year of the MERI is January - December 2007 = 100.

(v) An increase (decrease) in the index indicates a depreciation (appreciation) of the rupee.

Source: Financial Markets Operations Division.